How To Read My LWPT Bill

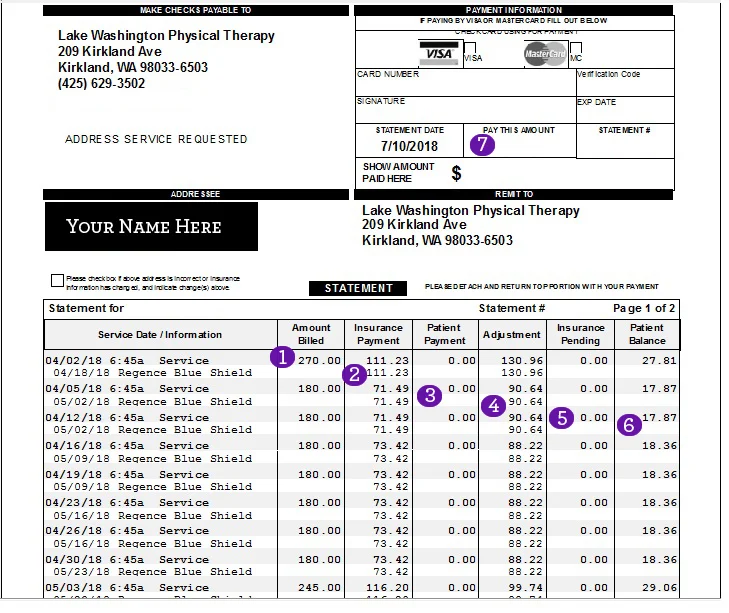

- Amount Billed - The full amount billed by your provider to your health plan.

- Insurance Payment - The portion of the charges eligible for benefits minus your copay, deductible, coinsurance, network discount and amount paid by another source up to the billed amount.

- Patient Payment - This section details the amounts that you have paid.

- Adjustment - The amount you save by using a provider that belongs to an Insurance network. Insurance payers negotiate lower rates with its in-network providers to help you save money.

- Insurance Pending - Is the amount that your insurance has yet to process on claims.

- Patient Balance - This section details the portion of the bill that is your responsibility to pay. This amount might include your copay, deductible, coinsurance, any amount over the maximum reimbursable charge, or products/services not covered by your plan. If you received payment intended for a provider, it is your responsibility to pay the provider.

Insurance Definitions

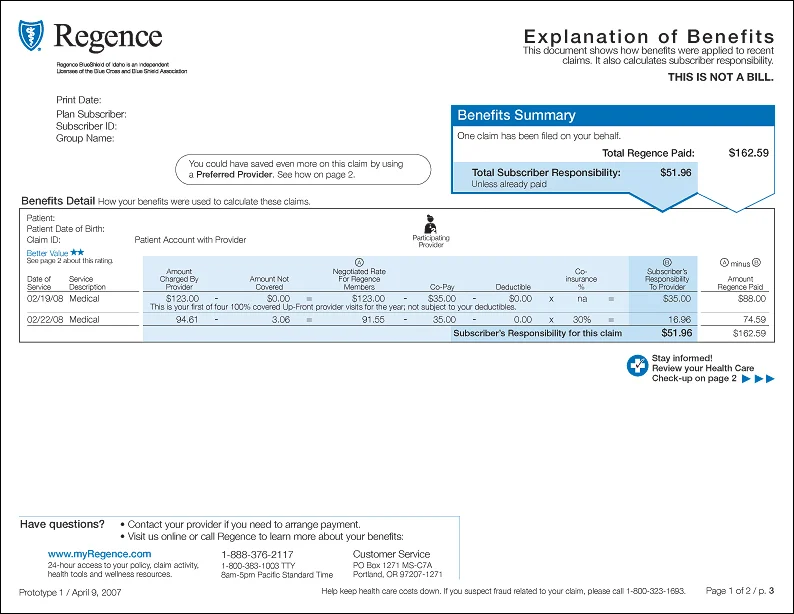

- Explanation of Benefits (EOB) - A claims statement that is sent whenever you use your health plan for services or products from a healthcare provider. It shows how your benefits cover the cost of a service from your provider and what you owe. The EOB is not a bill.

- Service/Product - The type of services or products you received from your provider.

- Dates of Service - The date(s) you received service.

- Amount Billed - The full amount billed by your provider to your health plan.

- Your Plan Discounts & Payments - This section details the amounts that you do not need to pay.

- Network Discount - The amount you save by using a provider that belongs to an Insurance network. Insurance payers negotiate lower rates with its in-network providers to help you save money.

- Amount Paid By Your Health Plan - The portion of the charges eligible for benefits minus your copay, deductible, coinsurance, network discount and amount paid by another source up to the billed amount.

- Amount Paid By Another Source - Examples of other sources include: a health funding account, other health insurance, automobile insurance, homeowners' insurance, disability insurance, etc. This amount may not be itemized and may only show in the Totals row of the Claim Detail.

- Copay - A set amount by your insurance plan that you pay for certain covered services such as office visits or prescriptions. Copays are usually paid at the time of service.

- Deductible - Your deductible is the amount you need to pay each year for covered services before your plan starts paying benefits.

- Coinsurance - A percentage of covered expenses that you pay after you meet your deductible.

- Amount Not Covered - The portion of the amount billed that was not covered or eligible for payment under your plan. Examples include charges for services or products that are not covered by your plan, duplicate claims that are not your responsibility, amount related to not getting a pre-approval for service, and any charges submitted that are above the maximum amount your plan pays for out-of-network care.

- Your Total Responsibility - This section details the portion of the bill that is your responsibility to pay. This amount might include your copay, deductible, coinsurance, any amount over the maximum reimbursable charge, or products/services not covered by your plan. If you received payment intended for a provider, it is your responsibility to pay the provider.

Questions

Call our centralized Billing Phone Number

1.866.451.7596

Pay By Phone

Downtown Kirkland Patients: 425.629.3502

Houghton Patients: 425.979.7445